- Introduction

- Function Introduction

- Performance Monitor

- Fusion Hunter

- Quantitative Chart

- SEC Filing

- Insider Trading (Search by Ticker)

- Insider Trading (Search by Reporter)

- Insider Trading (Top Insider Trading)

- Institutional Holdings

- Investment Trends (Investment Company List)

- Investment Trends (Sector & Industry Sentiment)

- Investment Trends (Investment Company Sentiment)

- Investment Trends (Top Institutional Trading)

- Investment Trends (Top Institutional Hldg Change)

- Key Ratio Distribution

- Screener

- Financial Statement

- Key Metrics

- High Current Difference

- Low Current Difference

- Relative Strength Index

- KDJ

- Bollinger Bands

- Price Earnings Ratio

- Price to Book Value

- Debt Equity Ratio

- Leverage Ratio

- Return on Equity

- Return on Assets

- Gross Margin

- Net Profit Margin

- Operating Margin

- Income Growth

- Sales Growth

- Quick Ratio

- Current Ratio

- Interest Coverage

- Institutional Ownership

- Sector & Industry Classification

- Data Portal

- API

- SEC Forms

- Form 4

- Form 3

- Form 5

- CT ORDER

- Form 13F

- Form SC 13D

- Form SC 14D9

- Form SC 13G

- Form SC 13E1

- Form SC 13E3

- Form SC TO

- Form S-3D

- Form S-1

- Form F-1

- Form 8-k

- Form 1-E

- Form 144

- Form 20-F

- Form ARS

- Form 6-K

- Form 10-K

- Form 10-Q

- Form 10-KT

- Form 10-QT

- Form 11-K

- Form DEF 14A

- Form 10-D

- Form 13H

- Form 24F-2

- Form 15

- Form 25

- Form 40-F

- Form 424

- Form 425

- Form 8-A

- Form 8-M

- Form ADV-E

- Form ANNLRPT

- Form APP WD

- Form AW

- Form CB

- Form CORRESP

- Form DSTRBRPT

- Form EFFECT

- Form F-10

- Form F-3

- Form F-4

- Form F-6

- Form F-7

- Form F-9

- Form F-n

- Form X-17A-5

- Form F-X

- Form FWP

- Form G-405

- Form G-FIN

- Form MSD

- Form N-14

- Form N-18F1

- Form N-18F1

- Form N-30B-2

- Form N-54A

- Form N-8A

- Form N-CSR

- Form N-MFP

- Form N-PX

- Form N-Q

- Form TTW

- Form TA-1

- Form T-3

- Form SC 14F1

- Form SE

- Form SP 15D2

- Form SUPPL

- Form 10-12G

- Form 18-K

- Form SD

- Form STOP ORDER

- Form TH

- Form 1

- Form 19B-4(e)

- Form 40-APP

- Form 497

- Form ABS-15G

- Form DRS

- Form MA

- Form UNDER

- AI sentiment

- Access guide

- Academy

- Term of service

- GDPR compliance

- Contact Us

- Question Center

| Font Size: |

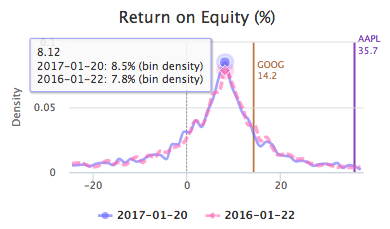

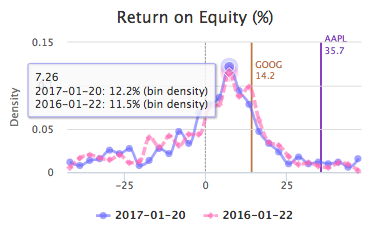

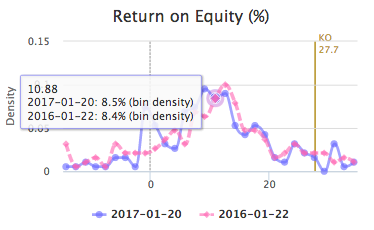

Return on Equity

Return on equity measures the percentage of return on shareholder's equity. In Katelynn's Report, it is calculated as Trailing 12 months Net Income/Shareholder's Equity * 100%. Return on equity generally reflects the efficiency of the management team in using equity investment to generate profit. Similar to most other financial ratios, return on equity can not be used independently to determine the performance of a business. For example, given the same amount of net income and total assets, return on equity could be higher in one company than another, because the former is financed mainly through debt (i.e. the proportion of equity is small), which is associated with a higher debt equity ratio (and higher leverage ratio too). Katelynn's Report assumes higher return on equity is generally more preferred (based on the assumption of holding other covariates as constant), and thus has better performance (i.e. higher quantile ranking).

Return on equity has industry and sector specific distribution. The figures below show the distributions of return on equity on the whole market (left), in technology sector (middle), and in consumer non-durable sector (right) as of 2017-01-20 (solid blue), compared with one year ago (dashed pink). The colored vertical lines marked the location of AAPL (Apple Inc.), GOOG (Alphabet Inc.), and KO (Coca cola Inc.)

|

|

|

Majority of companies have return on equity less than 20%. If too high, it is better to double check the leverage ratio first. According to the distributions shown above, the return on equity is slightly better (higher) in consumer non-durable sector (than technology sector and whole market), which has less companies with negative return and has peak appeared right of the peak of technology sector. We also noticed a slight shift to left in both sectors, comparing with one year ago.