- Introduction

- Function Introduction

- Performance Monitor

- Fusion Hunter

- Quantitative Chart

- SEC Filing

- Insider Trading (Search by Ticker)

- Insider Trading (Search by Reporter)

- Insider Trading (Top Insider Trading)

- Institutional Holdings

- Investment Trends (Investment Company List)

- Investment Trends (Sector & Industry Sentiment)

- Investment Trends (Investment Company Sentiment)

- Investment Trends (Top Institutional Trading)

- Investment Trends (Top Institutional Hldg Change)

- Key Ratio Distribution

- Screener

- Financial Statement

- Key Metrics

- High Current Difference

- Low Current Difference

- Relative Strength Index

- KDJ

- Bollinger Bands

- Price Earnings Ratio

- Price to Book Value

- Debt Equity Ratio

- Leverage Ratio

- Return on Equity

- Return on Assets

- Gross Margin

- Net Profit Margin

- Operating Margin

- Income Growth

- Sales Growth

- Quick Ratio

- Current Ratio

- Interest Coverage

- Institutional Ownership

- Sector & Industry Classification

- Data Portal

- API

- SEC Forms

- Form 4

- Form 3

- Form 5

- CT ORDER

- Form 13F

- Form SC 13D

- Form SC 14D9

- Form SC 13G

- Form SC 13E1

- Form SC 13E3

- Form SC TO

- Form S-3D

- Form S-1

- Form F-1

- Form 8-k

- Form 1-E

- Form 144

- Form 20-F

- Form ARS

- Form 6-K

- Form 10-K

- Form 10-Q

- Form 10-KT

- Form 10-QT

- Form 11-K

- Form DEF 14A

- Form 10-D

- Form 13H

- Form 24F-2

- Form 15

- Form 25

- Form 40-F

- Form 424

- Form 425

- Form 8-A

- Form 8-M

- Form ADV-E

- Form ANNLRPT

- Form APP WD

- Form AW

- Form CB

- Form CORRESP

- Form DSTRBRPT

- Form EFFECT

- Form F-10

- Form F-3

- Form F-4

- Form F-6

- Form F-7

- Form F-9

- Form F-n

- Form X-17A-5

- Form F-X

- Form FWP

- Form G-405

- Form G-FIN

- Form MSD

- Form N-14

- Form N-18F1

- Form N-18F1

- Form N-30B-2

- Form N-54A

- Form N-8A

- Form N-CSR

- Form N-MFP

- Form N-PX

- Form N-Q

- Form TTW

- Form TA-1

- Form T-3

- Form SC 14F1

- Form SE

- Form SP 15D2

- Form SUPPL

- Form 10-12G

- Form 18-K

- Form SD

- Form STOP ORDER

- Form TH

- Form 1

- Form 19B-4(e)

- Form 40-APP

- Form 497

- Form ABS-15G

- Form DRS

- Form MA

- Form UNDER

- AI sentiment

- Access guide

- Academy

- Term of service

- GDPR compliance

- Contact Us

- Question Center

| Font Size: |

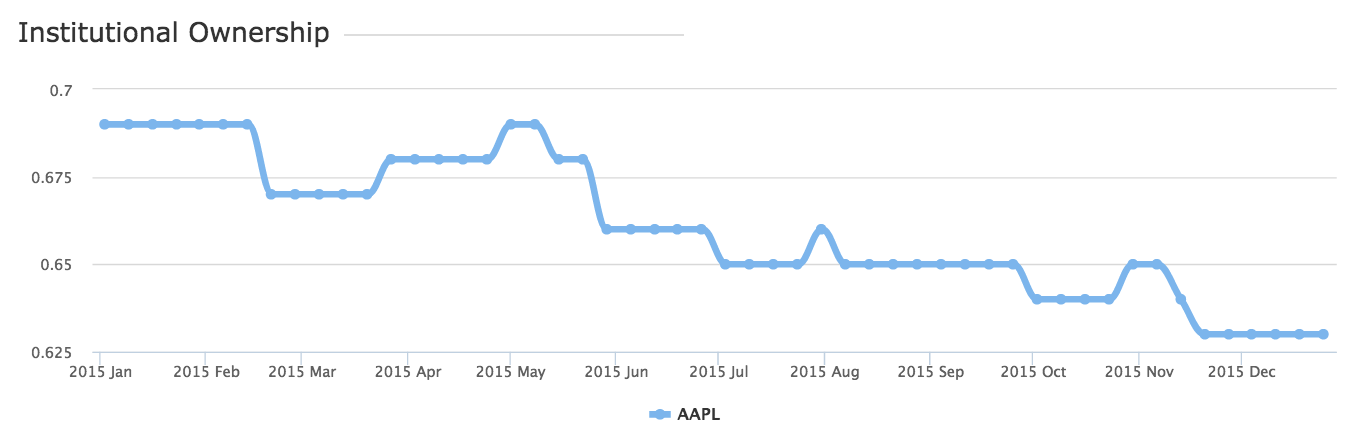

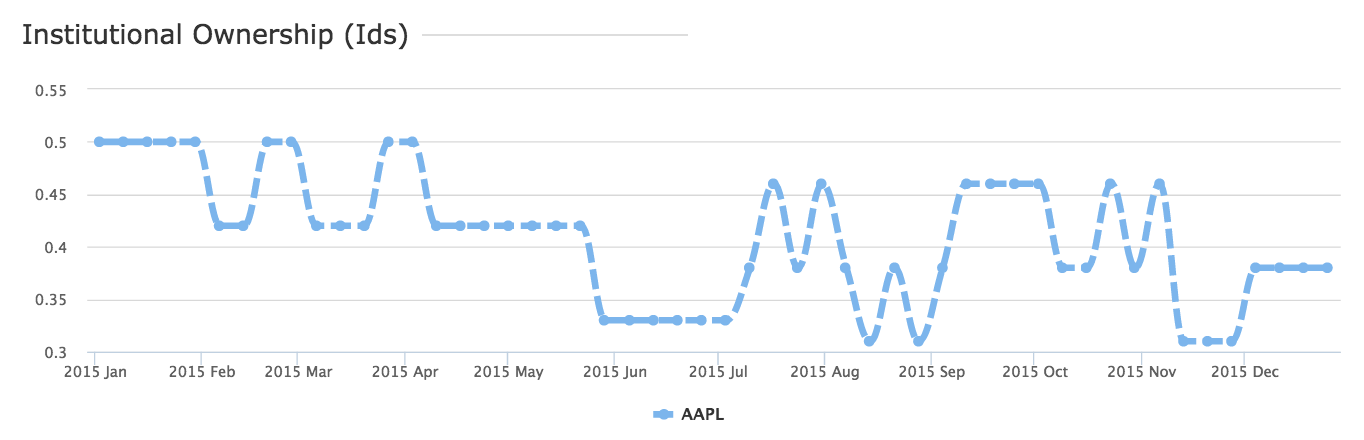

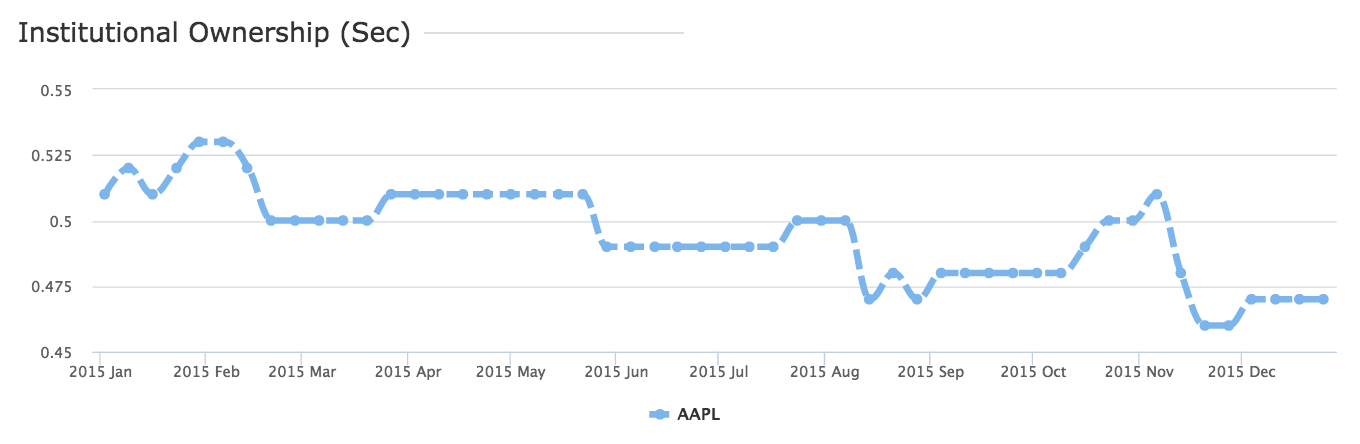

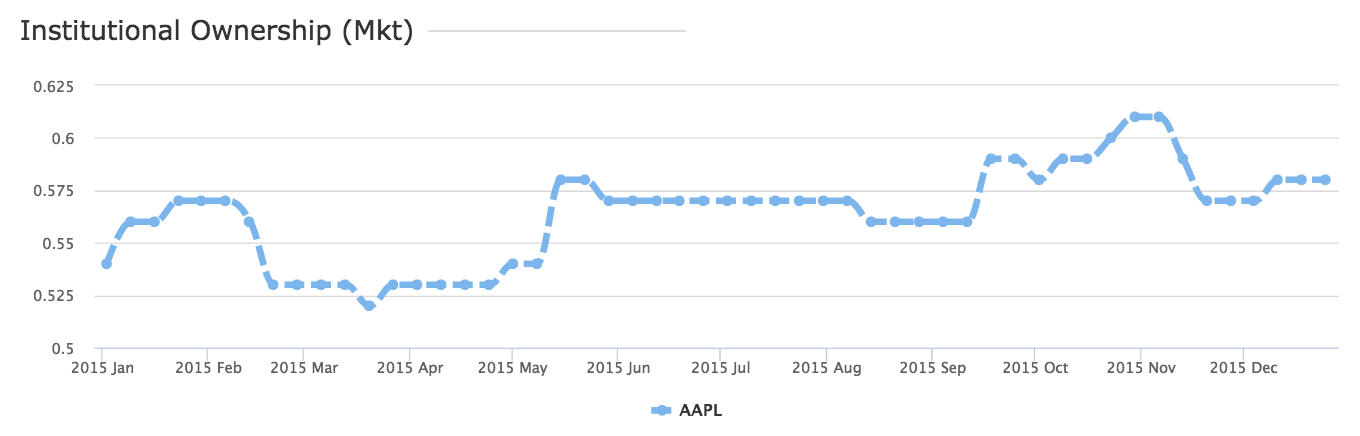

Institutional Ownership

Institutional ownership is summarized from holding information reported in Form 13F filing, which is filed quarterly by investment managers exercising aggregated investment discretion ≥$100 million. Institutional ownership is presented as the ratio of institutional holding to overall shares outstanding, and theoretically should be a value between 0 and 1*.

* Due to confounding factors including but not limited to Confidential Treatment, late filing, filing error, the ratio could be larger than 1.

Katelynn's Report tracks the reported holdings that are equal to or more than $200,000 and has less than 270 days time span between filing date and period of report (four periods each year). When holding information for current period is not available, the latest previous period is automatically used. Holdings that are more than 270 days old (due to Confidential Treatment) are considered out-of-date and dropped from analysis. This is for providing a more conservative view of the holding information.

Example 1: Apple Inc. (NASDAQ:AAPL) has institutional ownership of 0.63 as the end of Dec 25th 2015.

Intitutional Ownership:

As shown in the performance monitor, the intitutional ownership (0.63) is higher than 38% of industry peers, and 56% of other stocks on the whole market. The difference between industry level and market level performance suggests the institutional holding is generally higher in "Computer Manufacturing" industry than market average.

Historical Data

|

|

|

|

Holding history analysis indicates a decrease in institutional ownership from 0.69 to 0.63, and a decrease in performance relative to industry and sector peers. However, the performance monitor at market level shows slight increase, suggesting certain industry(s) other than "Computer Manufacturing", or certain sector(s) other than "Technology" have more decrease in institutional holding (there is actually massive sell-off in the energy sector during the same period of time).